Spade 101: Why Transaction Data Is So Messy – and How We Fix It

Each time you swipe your card, type it in online, or tap to pay, your payment races through a chain of banks, networks, and processors – all deciding in less than two seconds whether to approve or decline the charge. This system is known as the payments value chain.

As a transaction moves through that chain, the data gets distorted. Think of it like a game of telephone: each player passes along a message, but with strict character limits and inconsistent formats. By the time it reaches the end, what started as a clear purchase is often unrecognizable – and that isn’t changing. Transaction data still runs on decades-old standards built for speed and safety, not clarity, with each card network layering on its own quirks and having little incentive to share more detail than absolutely necessary.

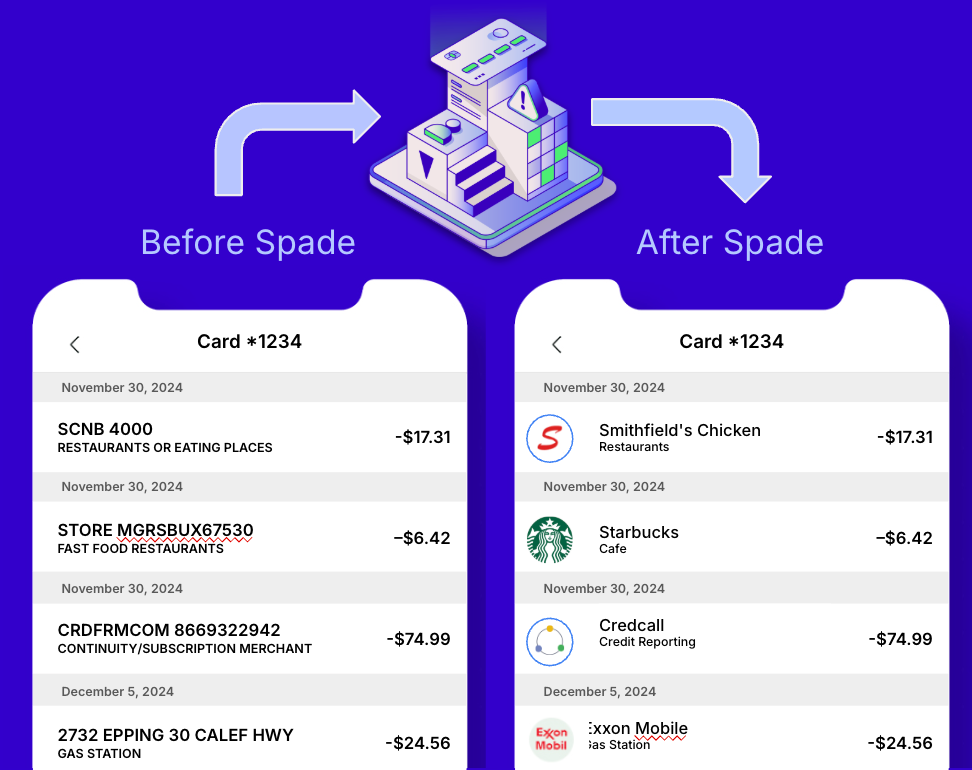

In your banking app, a coffee at Starbucks might appear as MGRSBUX 53846 10001 NEW YO, while a DoorDash order shows up as 1324144545DOORDASH*TAQ. On the customer side of things, this can be confusing and frustrating – leading people to question or dispute charges they don’t recognize. On the bank’s side, messy data doesn’t just create a bad customer experience, it makes it harder to block fraud, attribute rewards accurately, or train AI models that depend on clean, structured inputs.

The impact? Financial institutions are limited in their ability to build better products and services, and customers are left with confusion, blocked purchases, and a banking experience that feels anything but seamless.

How Spade solves this problem

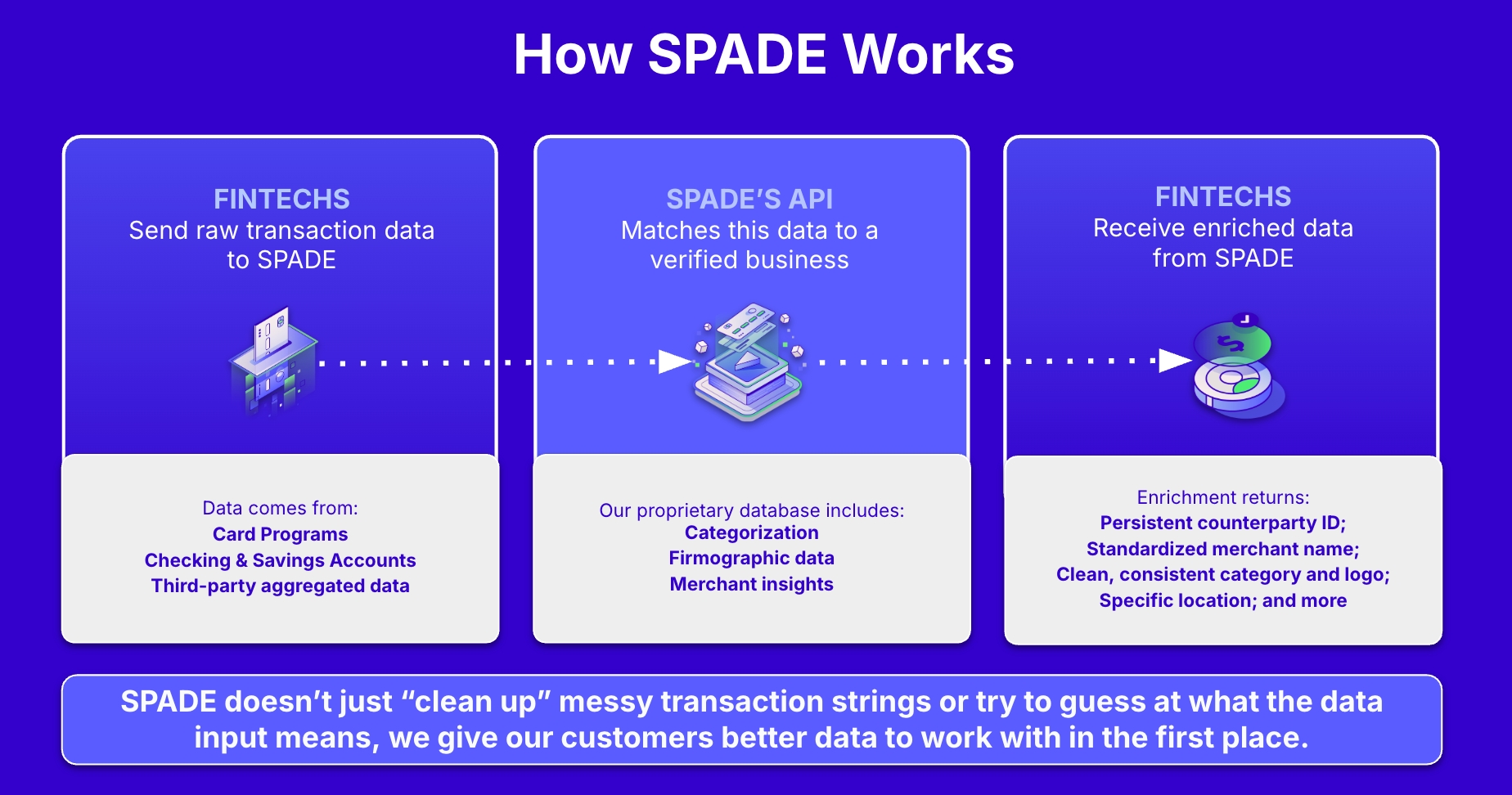

Spade enriches transactions in real time across cards, transfers, and third-party data. At the core of our technology is our proprietary counterparty database — covering more than 99% of payment-accepting merchants in the U.S. and Canada. Here’s how we use it:

And all of this can be done in under 50ms – fast enough to sit directly in a standard authorization flow without slowing down a transaction approval on the customer’s side. And because this enrichment is grounded in real, ground truth data, the results are consistent, transparent, and reliable.

Here’s what that looks like from the customer’s point of view:

What this unlocks

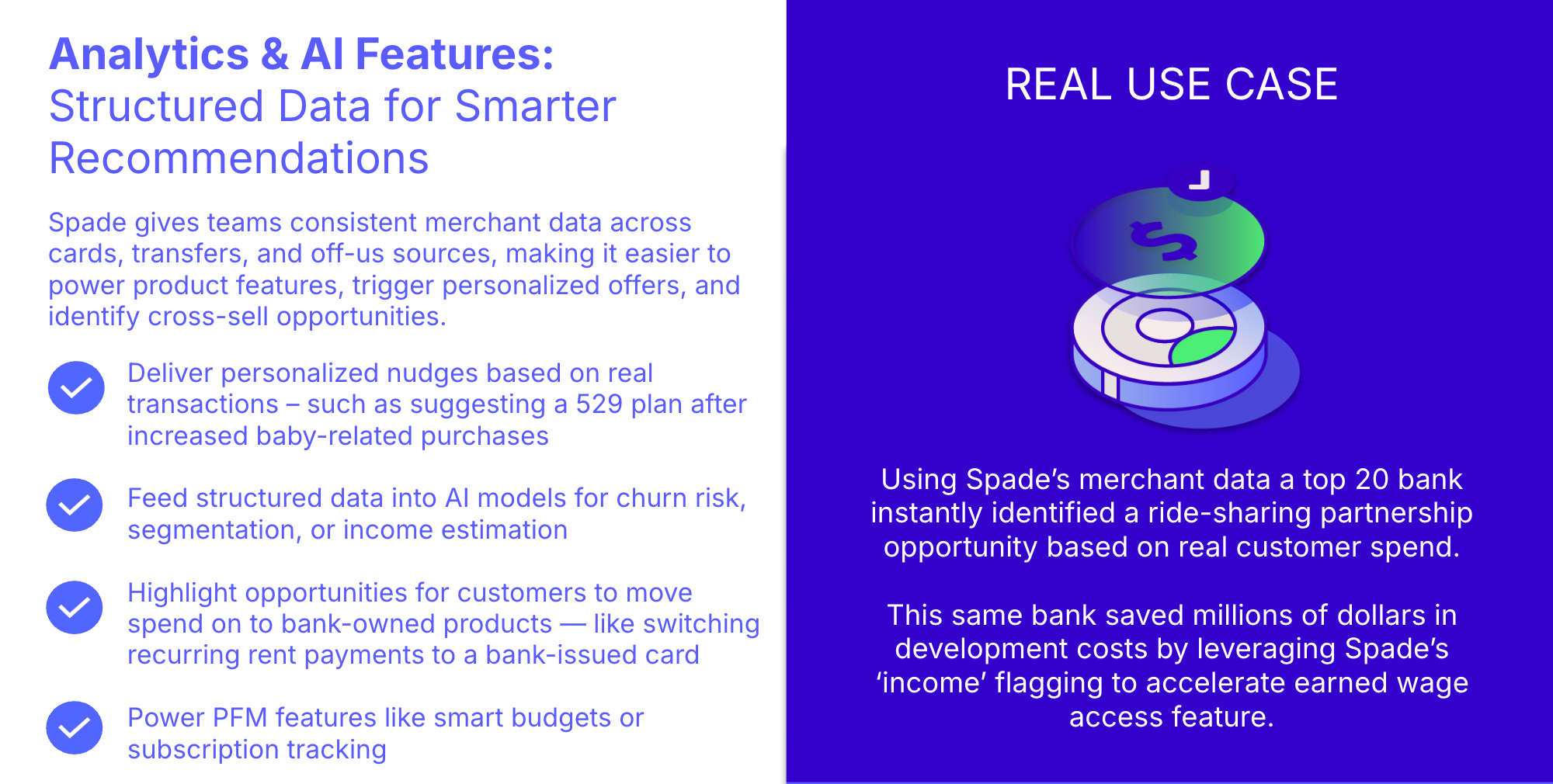

Spade enables teams to use enriched data across endless use cases across user experience, authorization, rewards, personalization, and AI tools. Here are just a few examples:

Closing the Gap

Up to this point, most solutions in the market have only patched one piece of the messy data problem. A fraud system here, a rewards vendor there — each tool solves for a sliver of the issue, but none of them fix the underlying data itself. That leaves banks juggling multiple vendors, and customers still stuck with confusing statements and inconsistent experiences.

Spade takes a different approach. Instead of trying to clean up the mess after the fact, we start with a ground-truth identity for every merchant and counterparty. That single source of truth flows through everything else: safer transactions that go through when they should, clearer statements customers can actually read, and offers that feel personal instead of generic.

For banks and fintechs, it means fewer disconnected systems to manage and a data foundation that can scale as they grow. But for customers, it’s even simpler: fewer blocked purchases, less confusion, and a financial experience that feels clearer and more in step with their actual lives.