Spade 101: What Is Real-Time Merchant Intelligence and Why Does It Matter?

Explore the payment process and Spade's solution for accurate transaction data, enhancing fraud detection and improving the financial ecosystem.

Unraveling the complexities of card payments and the transformative role of Spade in enhancing transaction data.

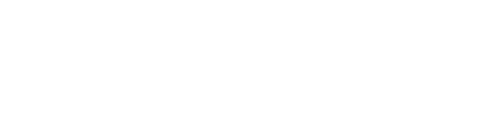

There’s a lot going on behind the scenes each time you swipe or type your credit or debit card. Getting money from you to the merchant you’re paying is a complex process with more stakeholders involved than you might guess – and it all has to happen in under two seconds. This process and the players involved are sometimes referred to as the payments value chain.

What is the payments value chain?

How it works:

What happens to the data through this process?

Think about what happens when you play a game of telephone, where you pass a message from person to person sitting next to each other – by the end of the game, the message is often unrecognizable. Now imagine you are doing that but each player is a bank or card network, and you have a 40 character limit for the message.

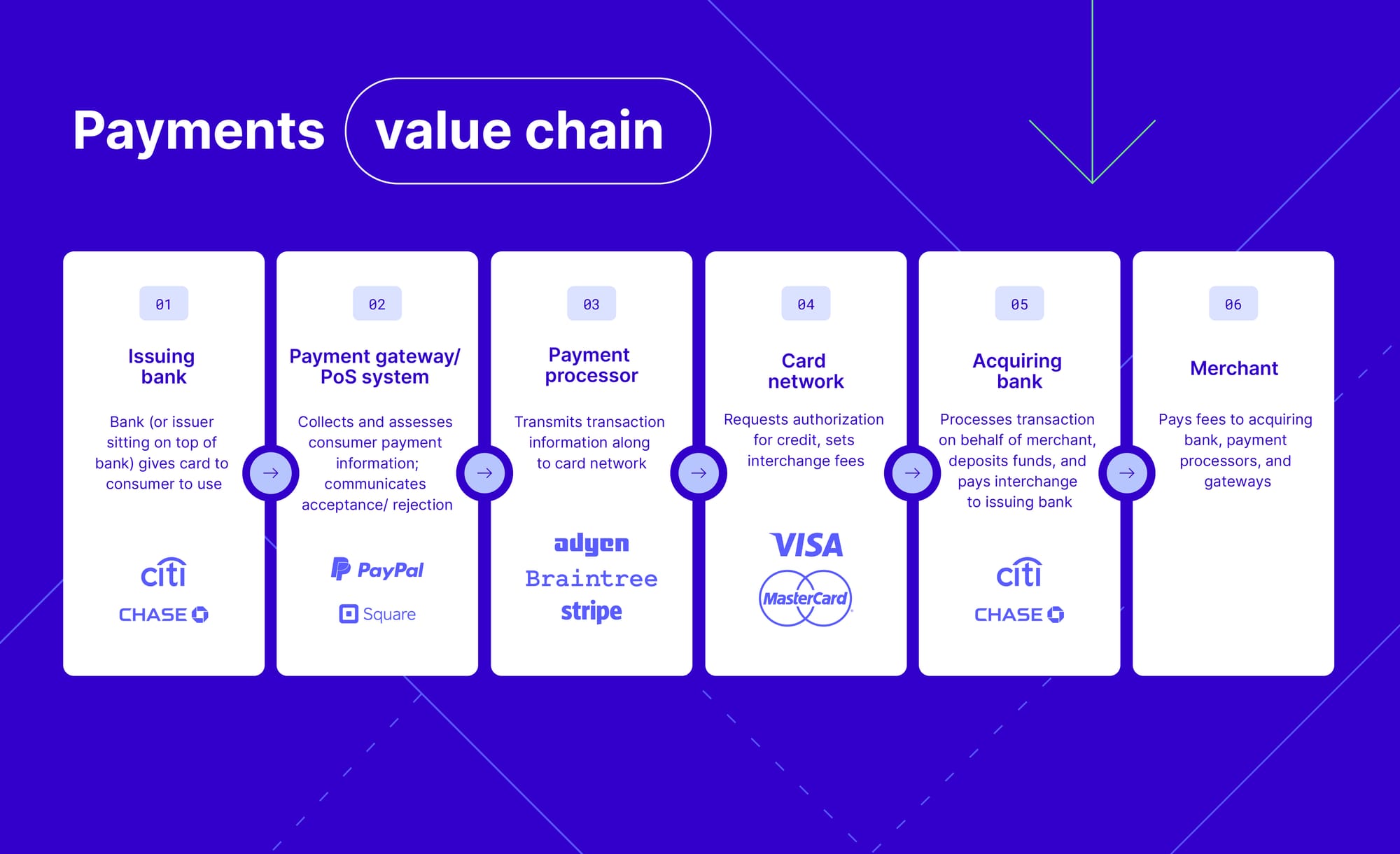

Unsurprisingly, by the time the data on a card transaction gets passed along the payments value chain, it is almost unrecognizable. The merchant involved in the transaction is obscured by a string of letters and numbers – a cup of coffee at Starbucks, for example, can look like “"MGRSBUX 53846 10001 NEW YO”.

That makes it really hard for the players in the value chain to make important decisions about whether to approve or decline a transaction. Financial institutions and consumers can struggle to recognize the purchase, and ultimately to take control of their spending.

This problem plagues the financial services ecosystem, and card issuers spend north of $60 billion trying to combat issues stemming from messy transaction data, such as card fraud, disputes, and chargebacks.

Why does this happen, and why hasn’t it been fixed?

Players in the value chain set an international communication standard for financial card transaction messaging called ISO 8583 to standardize the data and allow for effective and safe communication. ISO 8583 dictates the kind of information that can be sent along with a transaction by defining a set of standard fields (data elements) that remain the same in all systems and networks while leaving some additional space for network-specific details. However, there are hurdles that lead to data degradation:

- Each network (e.g. Visa network vs Mastercard network) adapts the standard for its own use, adding custom fields and creating additional complexity in the system.

- ISO 8583 character limits force out valuable information, leading to truncated merchant names and locations (e.g., 1324144545DOORDASH*TAQUERIA becomes 1324144545DOORDASH*TAQ).

- As information flows through the network, it’s often simply put into the wrong field (e.g, phone number frequently goes in the city field).

- Categorization of the business is limited by card network set category codes (MCC codes) that are often incorrect. Still, all Amazon purchases are labeled as ‘Book Stores’.

To make matters worse, all the players in the system are incentivized to limit the information they share due to competitive dynamics.

- Card networks are a lynchpin in the payments system and lack incentive to update their structure.

- POS systems and processors don’t want to share merchant information for fear of issuing banks and issuer-processors acquiring them as customers for competitive POS offerings.

Banks, businesses, advertisers, underwriters, and even consumers all rely on transaction data to do a variety of important things. Whether a traditional bank attempting to enhance digital banking experiences, an anti-fraud company monitoring billions of transactions for fraud, or a new card issuing platforms attempting to allow customers to make authorization decisions, innovators need accurate, detailed transaction data to build better financial products and services. Plus, it’s key for consumers to have clarity on their transactions to properly understand how and where they’re spending their money.

As the fastest and most accurate provider of real-time merchant intelligence for the card ecosystem, Spade solves this problem.

What Spade does:

The idea: If existing infrastructure fails to allow the right data to reach demanding market participants, there exists a massive opportunity to provide the extremely valuable context surrounding a financial transaction.

How does it work?

The typical approach to messy transaction data is to try to cleanse the transaction string that you see on your statement (oftentimes using ML). This can be unreliable, slow (think about speed of chat GPT vs Google), and limit the granularity of info returned - reducing ability to use data for high value use cases like fraud decisioning in the auth flow.

Spade took a unique approach. We built a proprietary ground truth database to cover nearly 100% of merchants across the US. When customers like Ramp, Unit, Sardine, and Mercury send us transactions, in real time (average of 20ms, p99 of 40ms) we match those transactions to a real merchant identity. When we match, we return everything from a clean name, logo, website, to an accurate category not based on MCC, to a consistent identifier for each location of a merchant, to an exact geolocation, down to the latitude and longitude.

Spade leads the market in terms of coverage (99.9% of US merchants) and speed (>5x faster than competitors). It’s the only transaction enrichment API backed by real data, enabling an auditable, fact-based enrichment process (no black-box models), better long-tail coverage, and provision of more granular data (e.g., higher geolocation match rates). This allows Spade to power unique and one-of-a-kind use cases such as:

Fraud detection and prevention: Improve accuracy of fraud detection models by >15%, sitting in the authorization as well as enhancing post-authorization fraud detection, e.g.:

- Using Spade’s proprietary categories, a bank identifies a transaction at FUNZPOINTS categorized by MCCs as a Video Game Arcade as a high risk Casino and Gambling transaction

- A customer files a dispute claiming a $1500 transaction was not them – combining Spade’s latitude longitude data on the merchant with device intelligence, a fintech identifies this as first party fraud

Authorization locking: Implement geographic, merchant, and category-based controls; approve and reject transactions in real time, e.g.,:

- A corporate card platform uses Spade and allows finance teams to issue cards to employees that can only be spent on certain categories (e.g., data storage), merchants (e.g., Datadog), or geographies (e.g., Las Vegas during Money2020)

- A fuel management card platform uses Spade and allows trucking companies to issue cards to their drivers for gas that only work along the most efficient geographic route at gas stations with pre-negotiated discount

Efficient dispute resolution: Reduce mistakenly filed disputes with detailed transaction information, e.g.:

- A consumer thinks fraud is committed when they don’t recognize the MGRSBX1349 transaction on their banking app so they call their bank, get on the phone with support (who has no additional information), and 30 minutes later, realize it’s the Starbucks purchase they made that morning on their way to work. If their bank used Spade - the purchase would have shown up as Starbucks located on their commute route, and the support agent would see that information too.

Rewards attribution: Correctly attribute rewards and increase acceptance rates (incl. through third parties), and build more granular rewards programs such as location based rewards, e.g.:

- A rewards platform wants to incentivize shopping local for food purchases. Using Spade’s location data, they can set geo-location parameters for rewards, and using Spade’s category data, they can accurately identify food purchases – even when those purchases happen through third parties like Square or Uber Eats.

Cardholder spend insights: Provide granular analytics and reporting, and identify trends in consumer behavior e.g.:

- Using Spade’s category system, a neobank identifies that a customer spends a lot on health products. They offer a rewards program for health spending and increase customer loyalty and lifetime value (LTV).

Generalized data improvements: improve transaction feeds and statements

- Using Spade’s logos and websites, a neobank cleans up their transaction feeds and finds customers spend more time engaging in the app (and reduced disputes).

- Using Spade’s category system, a corporate card platform improves automated P&L categorization – saving finance teams hours each week.

And we're just getting started – every day, we see new and innovative products being built using our merchant intelligence solution.