Spade & Unit: Enhancing card processing with clean, useful transaction data

Learn how an embedded finance platform helps its customers avoid the costs and hassles of external integrations with a native data enrichment solution through Spade.

How one embedded finance platform offers its customers a native data enrichment solution—and over 90% match rates—with Spade

About Unit

Since 2019, Unit has helped leading tech companies embed financial services like banking, lending, and cards seamlessly into their digital products. Unit offers the technology, compliance, bank partnerships, and operational components customers need to launch successful financial programs at scale—so they can tap into new revenue streams and delight users with innovative features.

The challenge

Generic and confusing transaction data made it difficult for Unit’s customers’ ability to deliver products that delighted customers.

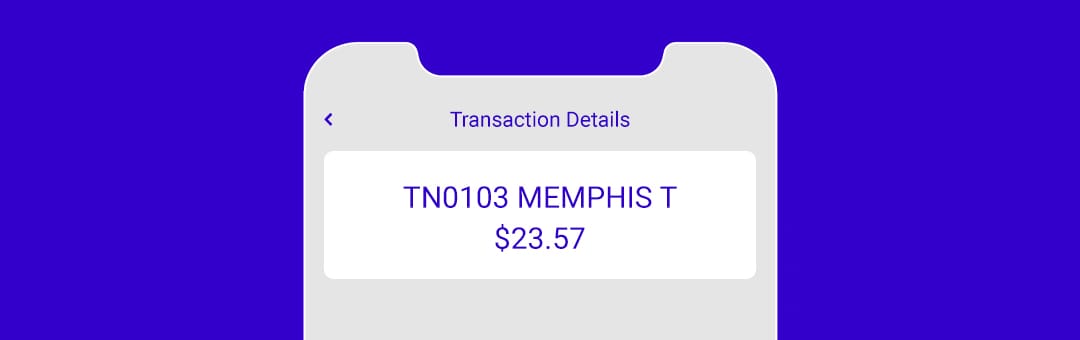

When Unit first launched, customers received raw transaction data.

But Unit’s customers could deliver better products if they had better transaction data. By enriching transaction data, companies embedding financial solutions could better understand their users’ financial behavior, present users with clean transaction feeds, and flag suspicious spending—reducing false disputes and fighting first-party fraud.

Some of Unit’s customers even began turning to other vendors to enrich the data for them. That’s when Unit saw an opportunity to offer a better solution as a native feature, saving customers substantial time, money, and hassle. They soon began a search for a best-in-class data enrichment partner.

The solution

With Spade’s API integrated into Unit’s product, customers get direct access to granular, real-time merchant intelligence

After running a bake-off with 1,000 transactions, Unit selected Spade for its industry-leading match rates, unparalleled data quality, and low-latency API—which can prove critical in card authorization decisions.

According to Unit’s platform and partnerships lead, Shweta Patwardhan, what really clinched the deal was Spade’s attentive, agile team.

“In addition to their market-leading product, one of the most important factors in choosing Spade was their amazing team,” said Patwardhan. “They’re smart and responsive. Even when snags arise, their attitude is, ‘Let's work it out. We can customize a solution for you or quickly roll out a change,’ and every time it results in an immediate improvement.”

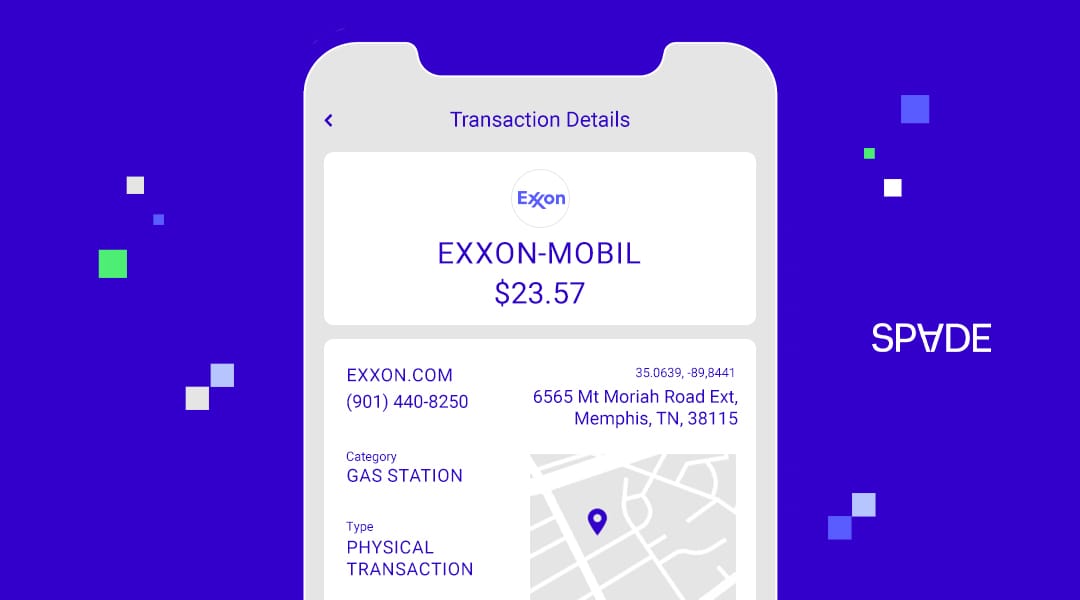

With Spade’s simple documentation, it took Unit less than two weeks to get their native Transaction Enrichment feature up and running. Now, Unit’s customers can opt in to receive clean, usable data for every eligible transaction—including one-to-one merchant identities and logos, precise spending categories, and exact geolocations—all without ever leaving Unit’s platform.

Key results

- Quick to market: With Spade’s attentive team and intuitive docs, Unit was able to get their native data enrichment solution live in just a couple of weeks.

- 90%+ match rates: With Spade, Unit’s customers consistently see over 90% match rates when gathering important merchant intelligence for their card users.

- <50ms p99 latency: Spade’s reliable API means Unit’s customers can count on accurate, real-time data that’s returned well within card authorization windows.

What’s next for Unit?

There are endless use cases for Spade’s enriched transaction data. Unit and Spade are working closely together to explore additional opportunities, like fraud model improvements and more.

Case in point: Unit just unveiled their White-Label App, offering customers a no-code way to launch branded banking and lending. Its activity stream will use Spade to report card activity in clear, human-readable text—making transaction data not only easy to access, but easy to understand.

Enhance your transaction data like Unit

Spade is the only transaction data enrichment platform that’s backed by real data, using ground truth—not guesswork—to deliver precise merchant, category, and geolocation details you can trust.

Get in touch with our team to learn how Spade can meet your needs and help you build exceptionally accurate, real-time transaction insights into your card offerings.